The most commonly asked question would have to be, “When should I start claiming Social Security retirement benefits?” While there isn’t a universal age that’s “better” than another age, there are factors you may want to consider before deciding to claim your retirement benefits. First, you’ll want to learn as much as you can about how claiming at particular ages affects your monthly benefits. There are also personal, and family situations where claiming at certain ages may be more beneficial if not necessary than deciding on other ages. The following tackles these circumstances and is meant provide you important information so that you can decide for yourself which age is best for you and your family.

Consider Personal Factors

If you begin claiming retirement benefits early you will receive a reduced monthly payment for a longer duration, but if you wait you will take home a larger amount each month but for a shorter duration. When deciding on which path to go on you need to consider your financial need, your health, and family circumstances. Also, take into account whether or not you’ll be working while in retirement and if you possess alternative sources of income. Start planning your future retirement budget which includes savings for emergencies; this will give you an idea of how much you’ll need from Social Security to support your planned retirement life. Don’t rush, deciding on when to claim Social Security retirement benefits is very serious because it will affect how much money you’ll receive for the duration of your life and it could impact benefit protection for any of your survivors.

Delay Claiming Benefits To Receive A Larger Benefit Amount

Your full retirement age is determined by which year you were born. Click here to learn what your full retirement age is. Your estimated Social Security benefit is determined by how much you earned during your working career. The exact amount that you’ll receive each month from Social Security is determined by the age of when you begin receiving benefits. You’re able to claim retirement benefits starting from age 62 until age 70, and your monthly benefits will increase each year you wait to claim. Your decision on when to claim benefits is a permanent affair and will determine your benefits for the duration of your life. You’ll receive annual cost-of-living adjustments in addition to a higher benefit amount if you continue working while in retirement.

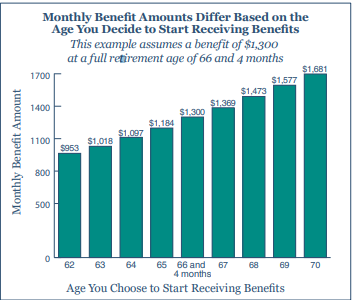

The following graph illustrates how delaying claiming benefits affects your monthly payments from Social Security:

For example, if in 2018 you turned 62, your full retirement age would be 66, and the amount you’ll receive each month starting at age 66 is $1,300. However, if you begin claiming retirement benefits at age 62, the SSA will lower your retirement benefits by 26.7% which would put you at $953 a month, but you will receive this over a more extended period compared to claiming at age 66. This reduction is permanent, and you won’t be able to appeal or affect it in any way. If you decide to wait until you’re 70, your retirement benefits will increase to $1,681. This is because the delayed retirement credits you accumulated after deciding to wait to claim social security retirements. If you claim at age 70, your monthly benefits would be 76% more than the retirement benefit amount you’d take home every month if you began claiming at age 62, so $728 more monthly.

You May Live Longer Than Expected

When planning you’re retirement, remember to consider the long term. It’s not uncommon for people to live longer than the average retirement age, and typically women live longer than men. Currently, one-third of the 65-year-olds will live until at least 90 years old, and 1 out of seven will age until at least 95. Social Security retirement benefits are provided to financial assist your life after you’re unable to continue working and as a safety net if you have no other sources of retirement income. Think it over, choose the retirement age that fits your personal and family situation the best, so you’re able to get the most out of Social Security.